-

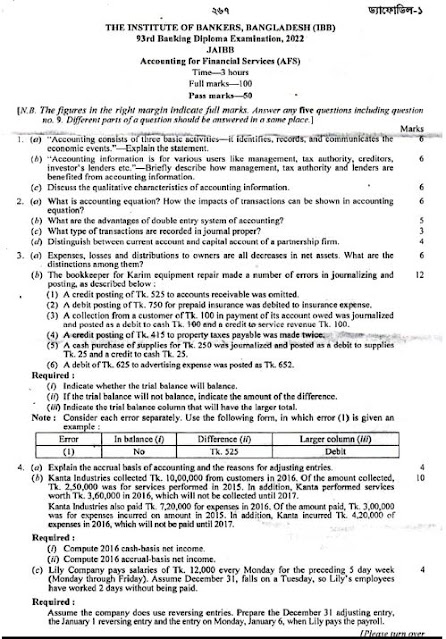

The Institute of Bankers, Bangladesh (IBB)

92nd Banking Diploma Examination

JAIBB

Accounting For Financial Services (AFS) Question 2021

JAIBB Banking Diploma Examination question of different years by Institute of Bankers, Bangladesh (IBB)

96th JAIBB Question 2023

1. Principles of Economics (POE)

2. Business Communication in Financial Institutions (BCFI )

3. Organization and Management

4. Laws and Practice of General Banking(LPGB)

5. Governance in Financial Institutions (GFI)

6. Monetary and Financial System (MAFS)

2. Business Communication in Financial Institutions (BCFI )

3. Organization and Management

4. Laws and Practice of General Banking(LPGB)

5. Governance in Financial Institutions (GFI)

6. Monetary and Financial System (MAFS)

92nd JAIBB Question 2021

1. Principles of Economics and Bangladesh Economy

2. Business communication

3. Organization and Management

4. Laws and Practice of Banking

5. Accounting For Financial Services

6. Marketing of Financial Services

November 2019

1. Principles of Economics and Bangladesh Economy

2. Business communication

3. Organization and Management

4. Laws and Practice of Banking

5. Accounting For Financial Services

6. Marketing of Financial Services

July 2019

1. Principles of Economics and Bangladesh Economy2. Business communication

3. Organization and Management

4. Laws and Practice of Banking

5. Accounting For Financial Services

6. Marketing of Financial Services

December 2018

1. Principles of Economics and Bangladesh Economy2. Business communication

3. Organization and Management

4. Laws and Practice of Banking

5. Accounting For Financial Services

6. Marketing of Financial Services

THE INSTITUTE OF BANKERS, BANGLADESH (IBB)

Banking Diploma Examination, November-December, 2018

JAIBB

Accounting for Financial Services (AFS)

Time—3 hours

Full marks—100

Pass marks—50

/NB.—The figures in the right margin indicate full marks. Answer any five

questions including question no. 9. Different parts of a question must be

answered in the same place.]

Marks

(b) Discuss the role of accounting in creating the process for values and accountability.

(c) What do you mean by conceptual framework of accounting? State the qualitative characteristics of accounting information.

2. (a) Define GAAP. State the importance and necessity of GAAP.

(b) What are accounting assumptions? Explain them with example. 8

(ç) What is cost-benefit constraints? Explain. 4

3 (a) State the effects of transactions over accounting equation.

(b) "Assets and expenses recording process are same”—Explain.

(c) "Income and liability accounts always show credit balance.” Why?

(d) What is visible and invisible transactions? Give some examples.

4 (a) Differentiate between expired and unexpired cost.

(b) How would you classify errors in book keeping? What errors does double entry unable to prevent and why?

(c) There was an error in the trial balance of A & Co. Ltd. on 3 1 st

December, 2017 and the difference in books was carried to suspense account. The following errors were detected after the close study of the books :—

(I) Tk. 900 received from Mr. Ahmed was posted to the debit of his account.

(ii) Tk. 400 being purchase returns were posted to the debit of purchase account.

(iii) Discounts Tk. 650 received were posted to the debit of discount accounts.

(iv) Tk. 1,000 paid for repairs to motor car was debited to Motor Car Account as Tk. 600.

(v) Tk. 1000 paid to H & Co. was debited to the account of B & Co.

Give Journal entries to rectify the above errors, and state what amount was carried to the Suspense Account.

5 (a) What is meant by receivables? Discuss about the classification of receivables

(b) What is allowance for doubtful accounts? Distinguish between had debts expense and allowance for doubtful accounts.

(c) Information related to Kap Shin Company for 2017 is summarized below

Total credit sales Tk.21,00,000

Accounts Receivable at December 31 8,37,000

Bad debts written off 33,000

Required

(i) What amount of Bad debt expenses will Kap Shin Company report if it uses the direct write off method of accounting for bad debts?

(ii) Assume that Kap Shin Company estimates its had debts expense to be 2% of credit sale. What amount of bad debts expenses will Kap Shin record if it has an allowance for doubt full accounts credit balance of Tk. 4,000?

(iii) Assume that Kap Shin Company estimates its bad debts expense based on 6% of accounts receivable. What amount of had debt expense will Kap Shin record if it has an allowance for doubtful account credit balance of Tk. 3,000?

(iv) Assume that the same facts as in (iii), except that there is a Tk. 3,000 debit balance in allowances for doubtful accounts. What amount of had debt expenses will Kap. Shin record?

6. (a) Which cost elements are included in inventory? What practical problems arise by including the cost of such elements?

(b) Differentiate between periodic and perpetual inventory system.

(c) Salsabil Autosales uses a FIFO perpetual inventory system. On April 1. the new car inventory records show total inventory Tk 72.000 consisting of the followings :—

| Model | Units | Unit Cost |

| A | 2 | Tk. 21000 |

| B | 2 | 15000 |

| April 5 | Purchascd | 3 | ‘A’ cars for Tk. 18000 each |

| 7 | Sold | 2 | “A” cars for Tk 19,200 each |

| 13 | Purchased | 2 | “B” cars for Tk 14,500 each |

| 17 | Sold | 1 | “A” car for Tk 1 8,500 |

| 28 | Sold | 1 | “B” car for Tk 21 ,000 |

Required:

(i) compute the cost of goods sold for the month of April.

(ii) Journalize the entries for the month of April.

7. (a) Define Break-even Point.

(b) “The Break-even chart is an excellent planning device.” Explain.

(c) The Kohinoor Chemical Company has sales of Tk. 3,60,000 and margin of safety 40% and P/V ratio 30%. An increase of fixed expenses and an increase of sales price have changed margin of safety to 35% and P/V ratio to 40%.

Required:

(i) break-even sales (ii) The amount of profit

The new break-even sales (iv) The new net profit

8. (a) Define depreciation. Discuss the methods of calculating depreciation.

(b) On October 1, 2018. Desktop Company acquired and placed into use a new equipment casting Tk. 5,00,000. The equipment has an estimated useful life of 6 years and an estimated salvage value of Tk. 20.000. Desktop estimates that the equipment will produce 200,000 units of products during its life. In the last quarter of 2018, the equipment produced 55,000 units of product. As the company’s

accountant. management has asked you to do the following :—

(i) Compute the depreciation for the last quarter of 2018. using each of

the following methods

(1) Straight Line (2) Units of production

(3) Sum of the years digits (4) Double declining balance

(ii) Calculate depreciation for 2019 using double declining balance method.

(iii) Prepare a written report describing the conditions in which of these methods would be most appropriate.

JAIBB coaching conducted by The Institute of Bankers, Bangladesh.

Lesson Plan

Nazmun Naher

Associate Professor, Accounting

Eden Mohila College, Dhaka.

Dated

|

Lesson Plan

|

29/10/18

|

Service, Merchandise and Manufacturing Operations. Cost of goods sold, income statement & Balance sheet (theory and sheet discussions.)

|

30/10/18

|

Income statement & Balance sheet (Math and Class Work)

|

31/10/18

|

Cash flow statement- Direct & indirect method and Limitations of Balance sheet.

|

01/11/18

|

Partnership and joint stock companies, Financial statement of bank and other financial institutes.

|

02/11/18

|

Inventory valuation- under periodic and perpetual methods for ascertaining closing inventory.

|

03/11/18

|

Valuation of closing inventory under average, FIFO, LIFO method.

|

04/11/18

|

Valuation of fixed assets, methods of depreciation and recording of depreciation.

|

05/11/18

|

Different types of journals, Cash book and bank reconciliation statement.

|

(1) “T” Account, Definition, Format and Example:

“T” accounts vertically divide page of the ledger in two equal halves. As they look like the capital letter “T” so are called “T” accounts. This method of preparing accounts helps to save time, space, and effort. It is preferably used for the class room demonstration, practice and rough work.

The left half or left hand side is termed debit, abbreviated as (Dr) and the right side is credit, abbreviated as (Cr). However, in practice, bookkeepers do not normally show the terms debit (Dr) or Credit (Cr) at the top of the accounts as there is no need to give them a reminder about these rules. Each half is further sub divided into four sections.

- Date column, to show date of the transaction.

- Details column, to provide cross reference with regard to the other account(s) involved in the ledger.

- Folio column, to provide additional reference of the item recorded in the account.

- Amount column, to record the monetary value of the item debited or credited to the account.

Because of double-entry mechanism, accountants record an accounting entry in a minimum of two T-accounts in order to envisage the complete impact of an accounting transaction on the accounting records.

(2) Three Column Ledger Account (Running Balance Method):

Definition and Format of Three Column Ledger Account:

In practice accounts are usually prepared in three column ledger account or running balance method, layout especially, when business uses an integrated computerized system. A familiar example of this form of account is a bank statement issued periodically by banks to their account holders. The major advantage of this form is that it shows the latest account balance at a glance. This form of account has six columns.

- Date column, to show date of the transaction for both debt and credit entries.

- Details column, to provide cross reference with regard to the other accounts involved in the ledger.

- Folio column, to provide additional reference of the item recorded in the account.

- Debit amount column, to record the monetary value of the item debited.

- Credited amount column, to record the monetary value of the item credited.

- Balance amount column, to show the net balance after each and every transaction, therefore this layout is called running balance method.

In manual accounting, this is time consuming and may lead to errors, however, using computerized accounting systems, balances are automatically calculated so there are less chances of errors.

The rules for debit and credit may be illustrated as:

The above rules for debit and credit dictate that an increase in an asset account reflected by a debit entry will be matched by a credit entry in either a liability/capital account (Up-arrow in liability/capital) or in another asset account (Down-arrow in another asset). In both instances a debit entry gives rise to a credit entry which is the essence of double entry concept which states that every debit has a corresponding credit with same and equal amount. However this must be remembered that both debit and credit effects may occur in only one side of the accounting equation.

As increase in asset accounts require debit entry in asset accounts so, as a result, at any point of time asset would always have a debit balance. Whereas increase in liability/capital accounts requires credit entry in respective liability/capital accounts, so as a result at any point of time they would always have a credit balance.

Video lecture on Depreciation

JAIBB

Accounting For Financial Services (AFS) Jun 2015

Question AND Soloution

Accounting information helps users to make better financial decisions. Users of financial information may be both internal and external to the organization.

Internal users (Primary Users) of accounting information include the following:

- Management: for analyzing the organization's performance and position and taking appropriate measures to improve the company results.

- Employees: for assessing company's profitability and its consequence on their future remuneration and job security.

- Owners: for analyzing the viability and profitability of their investment and determining any future course of action.

Accounting information is presented to internal users usually in the form of management accounts, budgets, forecasts and financial statements.

External users (Secondary Users) of accounting information include the following:

- Creditors: for determining the credit worthiness of the organization. Terms of credit are set by creditors according to the assessment of their customers' financial health. Creditors include suppliers as well as lenders of finance such as banks.

- Tax Authourities: for determining the credibility of the tax returns filed on behalf of the company.

- Investors: for analyzing the feasibility of investing in the company. Investors want to make sure they can earn a reasonable return on their investment before they commit any financial resources to the company.

- Customers: for assessing the financial position of its suppliers which is necessary for them to maintain a stable source of supply in the long term.

- Regulatory Authorities: for ensuring that the company's disclosure of accounting information is in accordance with the rules and regulations set in order to protect the interests of the stakeholders who rely on such information in forming their decisions.

JAIBB Accounting For Financial Service Math Solution -Last Edition May 2018 (Paperback) - BUY NOW

What is accounting?

Accounting is the recording of financial transactions plus storing, sorting, retrieving, summarizing, and presenting the information in various reports and analyses. Accounting is also a profession consisting of individuals having the formal education to carry out these tasks.

One part of accounting focuses on presenting the information in the form of general-purpose financial statements (balance sheet, income statement, etc.) to people outside of the company. These external reports must be prepared in accordance with generally accepted accounting principles often referred to as GAAP or US GAAP. This part of accounting is referred to as financial accounting.

What are the main objectives of Accounting?

- To keep systematic records: Accounting is done to keep a systematic record of financial transactions. In the absence of accounting there would have been terrific burden on human memory which in most cases would have been impossible to bear.

- To protect business properties: Accounting provides protection to business properties from unjustified and unwarranted us. This is possible on account of accounting supplying the information to the manager or the proprietor.

- To ascertain the operational profit or loss: Accounting helps is ascertaining the net profit earned or loss suffered on account of carrying the business. This is done by keeping a proper record of revenues and expenses of a particular period. The profit and loss account is prepared at the end of a period and if the amount of revenue for the period is more than the expenditure incurred in earning that revenue, there is said to be a profit. In case the expenditure exceeds the revenue, there is said to be a loss.

- To ascertain the financial position of business: The profit and loss account gives the amount of profit or loss made by the business during a particular period. However, it is not enough. The businessman must know about his financial position i.e., where he stands; what he owes and what he owns? This objective is served by the balance sheet or position statement.

- To facilitate rational decision making: Accounting these days has taken upon itself the task of collection, analysis and reporting of information at the required points of time to the required levels of authority in order to facilitate rational decision making.

Question: Bank Reconciliation::

i) Balance as per Bank statement 86129

ii) Deposit in transit 44700

iii) Outstanding cheque 1,29,478

iv) Bank error (deposit understated) 10,000

v) NSF cheque from customer debited to the account by the bank 2300

vi) Bank service charge for december 75

vii) Error of deposit book (cheque to pay creditor at Tk 300 but written for only tk 30) 270

viii) Bank Balance as per depositor recorded 31-12-2014 13,506

Solution:

i) Balance as per Bank statement 86129

ii) Deposit in transit 44700

iii) Outstanding cheque 1,29,478

iv) Bank error (deposit understated) 10,000

v) NSF cheque from customer debited to the account by the bank 2300

vi) Bank service charge for december 75

vii) Error of deposit book (cheque to pay creditor at Tk 300 but written for only tk 30) 270

viii) Bank Balance as per depositor recorded 31-12-2014 13,506

Solution:

| Particulars | Amount | Amount |

| Balance as per Bank statement | 86179 | |

| Add, Deposit in transit | 44700 | |

| Add, Deposit understated | 10000 | |

| 54700 | ||

| Less, Outstanding cheque | 129478 | |

| Correct Bank Balance | 11401 | |

| Balance as per depositor's book | 13506 | |

| Add, Deposit Book Error | 270 | |

| Less, NSF cheque | 2300 | |

| Less, Bank service charge | 75 | |

| 2375 | ||

| Correct Bank Balance | 11401 |

Q. 4(d)

A) Prepare bank reconciliation statement showing corrected balance in Both Bank statement and Aruna Traders ledger account

Solution:

| Auroni Traders | ||

| Bank Reconciliation statement |

| Particulars | Tk | Tk. |

| Bank Balance as per Bank statement | 40,001.36 | |

| Add, Deposit after Banking Hour | 3,287.20 | |

| Bank Balance | 43,288.56 | |

| Less, Outstanding cheques | ||

| (1640+800+82+3220) | 5,742.00 | |

| Correct Cash Balance | 37,546.56 | |

| Bank Balance as per books | 34,102.64 | |

| Add, Proceed from collection | 4,000.00 | |

| Add, Interest earned on deposit | 219.92 | |

| 4,219.92 | ||

| 38,322.56 | ||

| Less, Fees charged plus vat | 40.00 | |

| Cheque for collection but return unpaid | 591.00 | |

| Bank service charge and vat | 96.00 | |

| Income tax | 22.00 | |

| 749.00 | ||

| Less, Errors over statement (896-869) | 27 | |

| Total less | 776.00 | |

| Corrected Bank Balance | 37,546.56 | |

যদি Bank Balance as per Bank statement দিয়ে শুরু হয় তবে Outstanding cheques amount বিয়োগ করতে হবে।

একটি সহজ নোটঃ

- যদি Bank Balance as per Bank statement দিয়ে শুরু হয় তাহলে এটার অর্থ হল আমি Bank Balance as per Bank statement এর correct balance বাহির করব। এক্ষেত্রে সাধারনত কিছু নিয়ম মনে রাখলে সুবিধা হয়ঃ

- wrongly debited from this account

-deposited by customer after bank hour

- cheque in transit

- wrongly less posted by bank officer

Less,

- Outstanding cheque (cheque issued by company but not cashed or not presented to the bank)

- wrongly credited

JAIBB Accounting Tutorial পর্ব-৩ঃ

পর্ব-১ এবং পর্ব-২ এ আমরা Basel related অংক করার নিয়ম এবং জুন-১৪ অংকের সমাধান করেছি।

আজকের পর্বে আমরা ব্যাংক Reconciliation statement কিভাবে করে সেটা দেখব।

Post গুলো শেয়ার করে ছড়িয়ে দিন।

General Rules:

-------------------

If the reconciliation statement starts with the ‘Balance as per Cash Book’:

- Add (Plus) all the ‘credit’ transactions of Cash Book /Pass Book with the balance

- Subtract (Minus) all the ‘debit’ transactions of Cash Book /Pass Book with the balance

পর্ব-১ এবং পর্ব-২ এ আমরা Basel related অংক করার নিয়ম এবং জুন-১৪ অংকের সমাধান করেছি।

আজকের পর্বে আমরা ব্যাংক Reconciliation statement কিভাবে করে সেটা দেখব।

Post গুলো শেয়ার করে ছড়িয়ে দিন।

General Rules:

-------------------

If the reconciliation statement starts with the ‘Balance as per Cash Book’:

- Add (Plus) all the ‘credit’ transactions of Cash Book /Pass Book with the balance

- Subtract (Minus) all the ‘debit’ transactions of Cash Book /Pass Book with the balance

Bank Reconciliation Statement ফরমেটঃ

RECONCILIATION STATEMENT

-----------------------------------------

Name of the Trade /Business …………

Bank Reconciliation Statement

As at ------- 200—

Particulars Amount (Tk.) Amount (Tk)

Bank balance as per Cash Book or Bank Overdraft

Add: (যোগ করতে হবে)

-----

1. Cheques issued or drawn but not presented to the Bnak in

time

for payment.

2. Profit on bank balance

3. Cash or cheques paid or deposited by the customers directly

into the Bank

4. B/R, income from securities, dividend, insurance claims, etc.

collected or realized by the Bank directly

5. Items already credited to Cash Book but not debited to

Pass Book

6. Items already credited to Pass Book, but not debited to

Cash Book

RECONCILIATION STATEMENT

-----------------------------------------

Name of the Trade /Business …………

Bank Reconciliation Statement

As at ------- 200—

Particulars Amount (Tk.) Amount (Tk)

Bank balance as per Cash Book or Bank Overdraft

Add: (যোগ করতে হবে)

-----

1. Cheques issued or drawn but not presented to the Bnak in

time

for payment.

2. Profit on bank balance

3. Cash or cheques paid or deposited by the customers directly

into the Bank

4. B/R, income from securities, dividend, insurance claims, etc.

collected or realized by the Bank directly

5. Items already credited to Cash Book but not debited to

Pass Book

6. Items already credited to Pass Book, but not debited to

Cash Book

Less: (বিয়োগ করতে হবে)

-------

2. 1. Bills/Cheques deposited into Bank, but not yet collected or

cleared.

2. Bills/Cheques deposited into Bnak, but returned dishonoured

3. Bank charge, commission, profit on overdraft, etc. not yet

credited to Cash Book

4. B/P, Insurance premium, utility bills etc. paid by the Bnak

5. Items already debited to Cash Book, but not credited to

Pass Book

6. Items already debited to Pass Book, but not credited to

Cash Book

Bank Balance as per Pass Book or Bank Overdraft as per Cash

Book

-------

2. 1. Bills/Cheques deposited into Bank, but not yet collected or

cleared.

2. Bills/Cheques deposited into Bnak, but returned dishonoured

3. Bank charge, commission, profit on overdraft, etc. not yet

credited to Cash Book

4. B/P, Insurance premium, utility bills etc. paid by the Bnak

5. Items already debited to Cash Book, but not credited to

Pass Book

6. Items already debited to Pass Book, but not credited to

Cash Book

Bank Balance as per Pass Book or Bank Overdraft as per Cash

Book

এই নিয়ম গুলো মনে রাখলে অংক করা সহয হবে। পরের পোষ্টে অংকের সমাধান দেয়া হবে ইনশাআল্লাহ।

Some Bank reconciliation solution:

Accouting Tutorial: Bank reconciliation statement [JAIBB Jun 2014]

JAIBB Accounting Tutorial: Bank Reconciliation [Jun 2015]

Some Bank reconciliation solution:

Accouting Tutorial: Bank reconciliation statement [JAIBB Jun 2014]

JAIBB Accounting Tutorial: Bank Reconciliation [Jun 2015]

| JAIBB Jun 14 Accounting | |||||

| Q. 8© | |||||

| B. Required capital is 10% of RWA. Show in this situation the status of required capital is deficit or surplus | |||||

| Solution: | | | | | |

| Total RWA | 83664200000 | | |||

| 10% of Total RWA | 8366420000 | = 837 crore | | ||

| We know minimum capital requirement is 400 crore as per Risk Base capital guideline (RBCG). | | ||||

| Hence required capital is surplus by 837 -400 = 437 crore | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | ||||

| | | | | | |